In the last post, we began our investigation into attitudes toward holiday shopping. We noted that the media’s focus on supply chain disruptions had the potential to dampen consumer attitudes toward the shopping experience, but that we hadn’t yet seen a negative impact on sentiment.

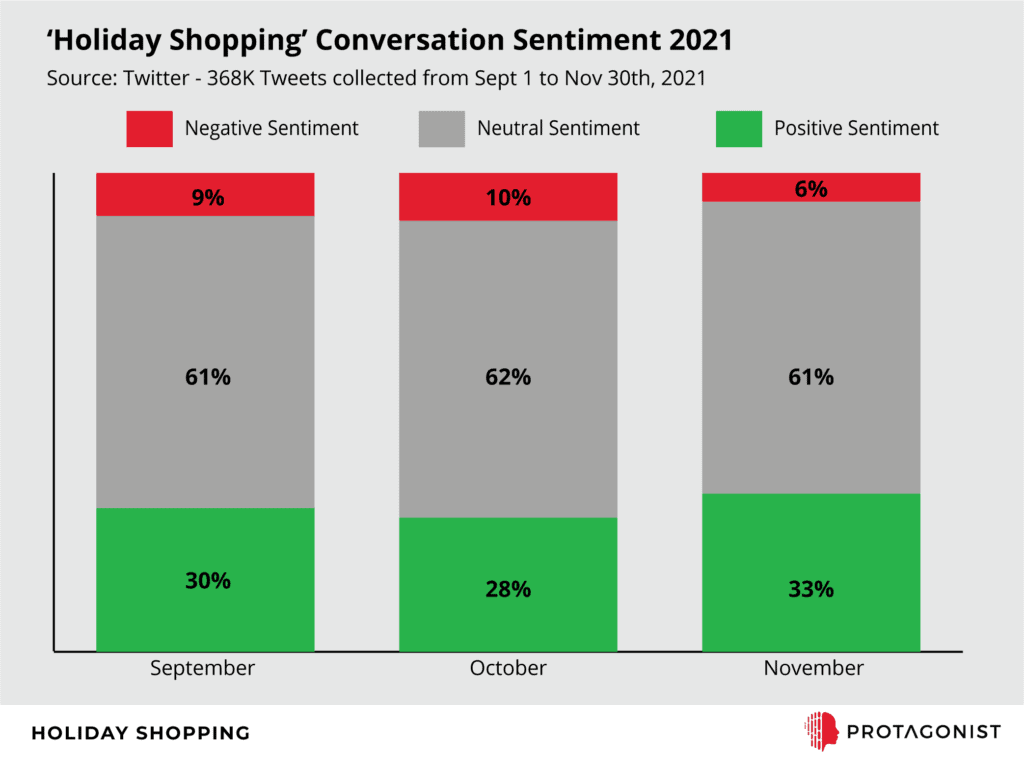

In the spirit of holiday cheer, we’re pleased to report that positive feelings have held strong. As the graph below shows, the sentiment about holiday shopping has grown significantly more positive as the gift-buying season has progressed.

Part of the reason sentiment improved may be due to pleasant surprises regarding the potential supply chain issues. As we dug into the data, we saw people noting that Target’s shelves were well-stocked and product availability on Amazon was solid. People praised these big retailers for getting ahead of the supply chain problem, and making holiday shopping easier than many had feared it would be.

Seeing this praise made us wonder how attitudes toward large retailers compared to one another, and to the conversation around small businesses—as we noted in the last newsletter, support of small businesses constituted a major portion of the positive holiday shopping conversation in 2020.

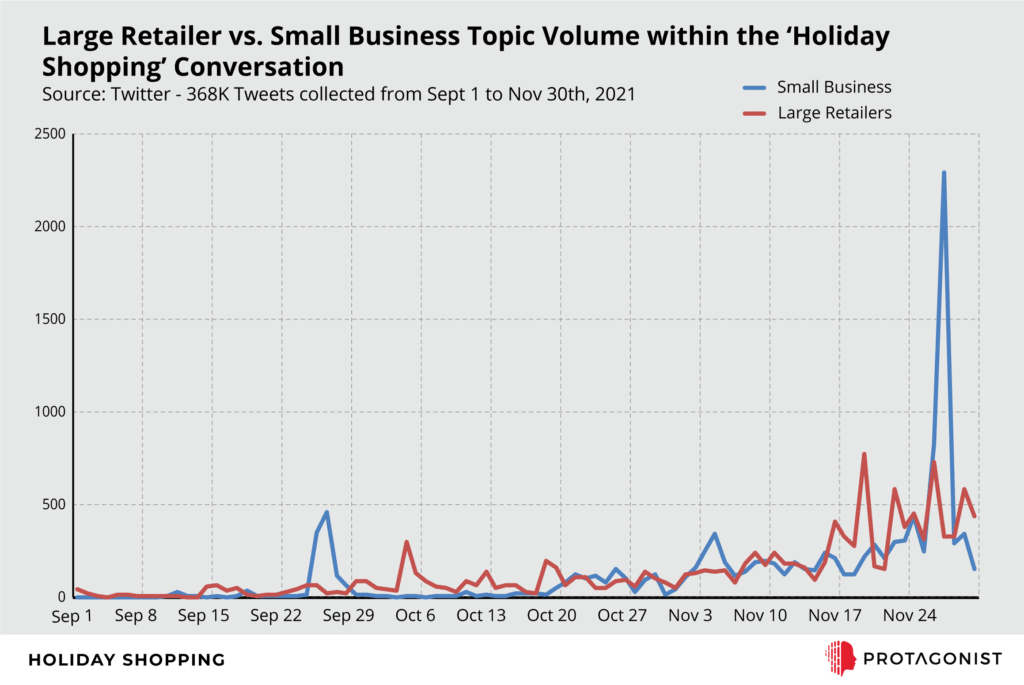

As the graph above shows, small businesses figured prominently in the holiday shopping conversation again this year, comparable in most periods to the conversation mentioning the large retailers Amazon, Target and Walmart. It’s clear from the data that people really want to support small businesses during this second pandemic-affected holiday shopping period.

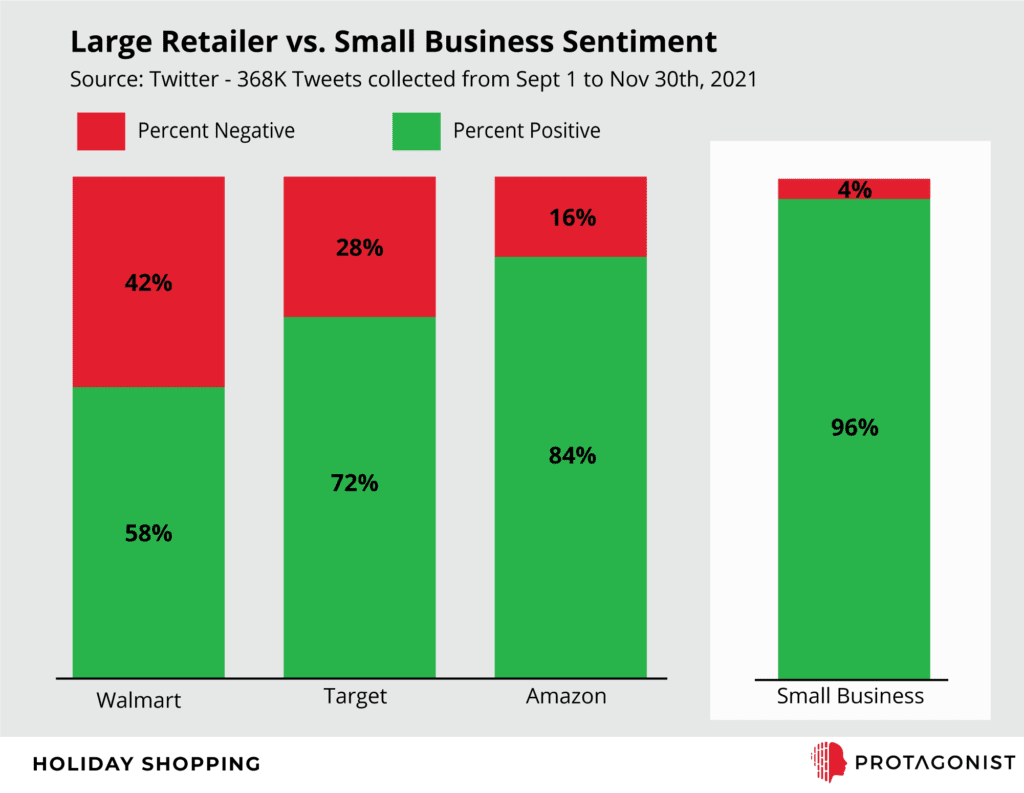

The sentiment toward small businesses was even more positive than the sentiment toward the big retailers. While people praised the larger companies for averting supply chain disasters, they also criticized those same companies for their market power, and cheered on small businesses for bringing products to shelves in spite of not having the same level of supply chain influence as large companies.

Amazon received significant praise for the convenience of 2-day shipping, and for their support of nonprofits through the Amazon Smile program. But the conversation also exhibited a significant dose of criticism for Amazon’s near-monopoly power having a detrimental effect on small businesses.

On the other end of the spectrum, Walmart’s success with the supply chain did not as strongly counterbalance negative sentiment toward their in-store experience. People also criticized Walmart for the unfortunately timed cancellation of their layaway program, which has made holiday shopping more stressful.

Target scored positive points by addressing the supply chain challenge explicitly and then executing successfully. Stocking shelves well, as mentioned, and then using clever strategies like early Black Friday sales contributed significantly to their strong positive balance.

Interestingly, inflation, which in the media has now largely supplanted supply chain as the negative issue receiving focus, had not yet garnered significant attention in the holiday shopping conversation by end-November. We are curious to see if the inflation issue ends up influencing attitudes as the holiday shopping season wraps up.

Using unprompted, organic conversations to gain insight into how companies are perceived is a core component of Narrative Analytics. If you’d like to learn more, reach out to us at info@protagonist.io.