During the pandemic, people started discussing student loans more, especially as many faced the potential of mounting payments during an uncertain time. We looked at this conversation in 2021 and found several narratives surrounding student loan forgiveness, predatory lending and the value of higher education.

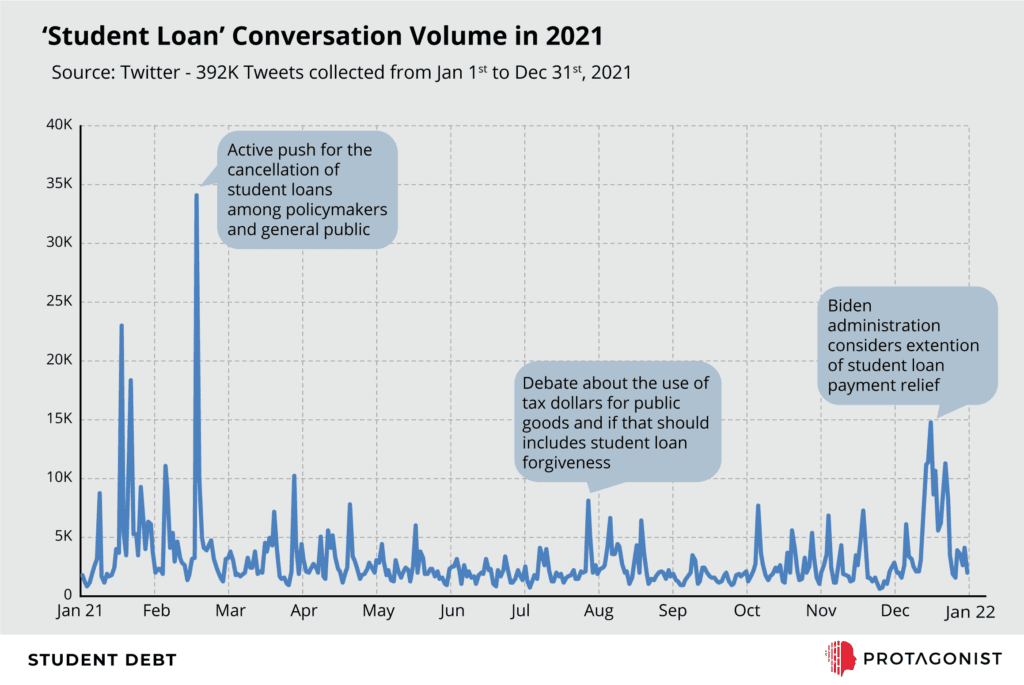

The following visual shows how the conversation volume fluctuated, with topics such as student loan cancellation, changes to interest rate policies and reformation of the entire student loan system driving significant activity.

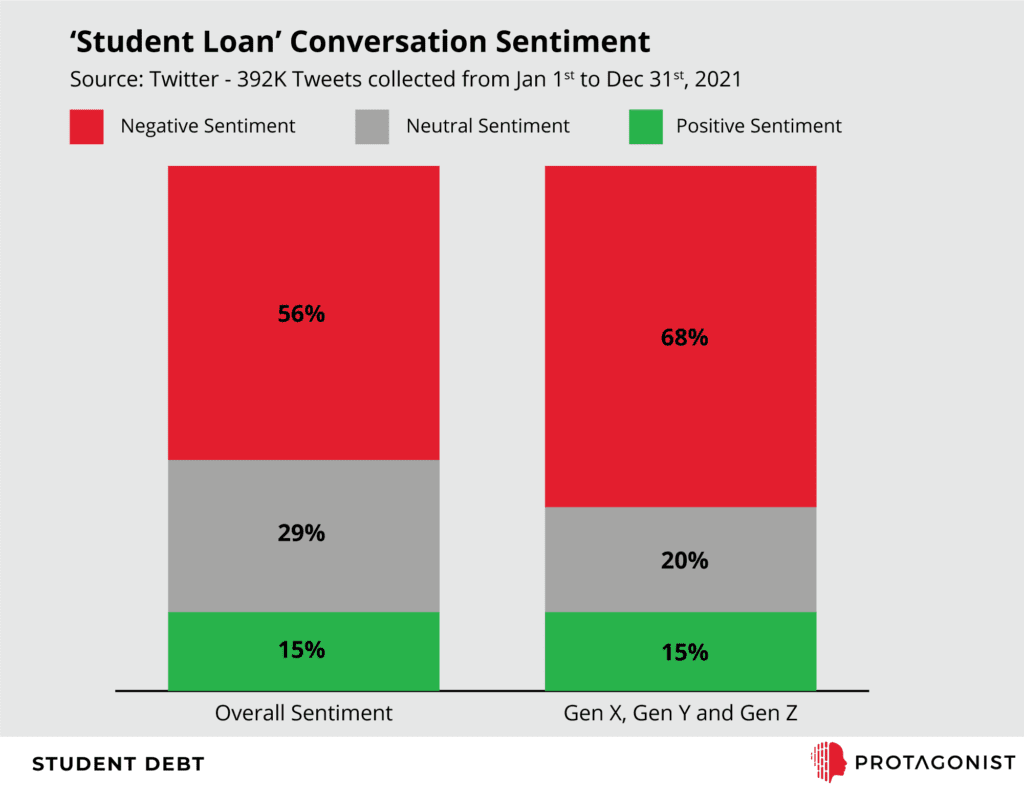

After assessing the overall conversation, we turned our attention to the generations most affected—Gen X, Millennials (Gen Y) and Gen Z. As expected, these generations felt more negative towards this topic than the general public, as shown in the visual below.

Taking a deeper dive into the conversation, we found that each generation’s sentiments are motivated by different drivers. As the oldest of the three generations, Gen X must balance many kinds of debt—mortgages, car payments and student debt. As the parents of students attending college, many in Gen X are simultaneously paying off their own student loans while supporting their children’s education. To make matters worse, many in this audience feel they are ‘erased’ from the overall conversation as the traditional media focuses on Millennials.

As the generation that graduated into the Great Recession, Millennials highlight the false promises of higher education. When they were students, many Millennials believed in the narrative of a college degree as a gateway to higher paying jobs and a path out of generational poverty. Instead, when they graduated they couldn’t find jobs and didn’t enjoy the prosperity their parents had. The narrative has become a myth for Millennials, and their student loan payments are a constant reminder of that broken promise.

As a generation with activism central to its identity, Gen Z advocates for more radical changes to the student loan system. They call for free college education and outlawing predatory lending. Gen Z is particularly focused on equity. They note that those who are less fortunate experience more harm when society views college as the only acceptable path to success, but then doesn’t provide jobs with sufficient income to pay off student debt. In the eyes of Gen Z, only a “cancellation of the student loan machinery” can solve these problems.

These three generations all dislike student loans, but the reasons for their feelings are different. They each live in a specific context that drives their narratives about student debt, and those narratives surface in their organic conversations online. Understanding audience narratives in detail is key for any organization seeking to understand a target audience.